Public Provident Fund - PPF Withdrawal

- Home

- PPF Withdrawal

PPF Withdrawal Criteria

| Withdrawal Type | Duration | Withdrawal Reason | How much amount? |

|---|---|---|---|

| On PPF Mature | After 15 years | Any Reason | Total Amount |

| Partial Withdrawal | After 5 years | Any Reason | 50% of PPF balance |

| Premature Closure | After 5 years | Medical or Education purpose | Total Amount |

PPF Withdrawal Rules

- Withdrawals are permitted only after completion of 7 years from the day of PPF account opening.

- One can withdraw at starting of financial year.

- Only 50% of the closing balance at the end of the 4th year prior to the year when the money is being withdrawn or 50% of the closing balance of the previous year, whichever is lower will be the limit.

- If a loan has been taken from the PPF account, the loan amount will be deducted from the amount that can be withdrawn.

- Only one withdrawal is allowed per financial year.

Premature Withdrawal of PPF

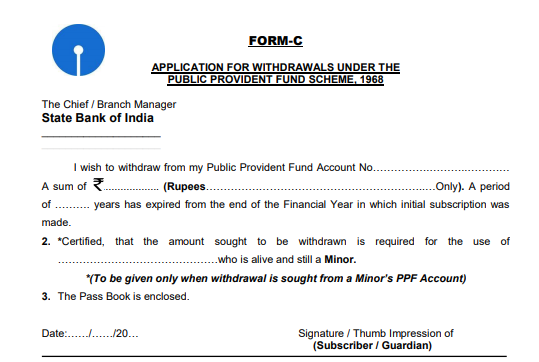

PPF account holder can make partial withdrawal right after the completion of the 5th financial year. The PPF premature withdrawal will be useful at the times of financial emergencies such as medical treatments and higher education of children. Subscriber can withdraw only 50% of the accumulated amount by the 5th year of investment. Withdrawal amount can be higher if account holder has invested between 7 years and 12 years. Subscriber have to use Form C with duly filled account information to withdraw amount from banks or post offices.

PPF withdrawal forms

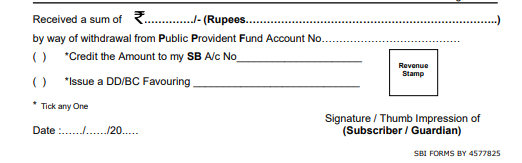

You can make a partial withdrawal from PPF account using Form C. PPF account holder have to submit passbook with duly filled form and affixed a revenue stamp to the form. Form is devided in main two parts, one for basic account information and second is acknowledgement. Form look like following.

Form C Acknowledgement Part